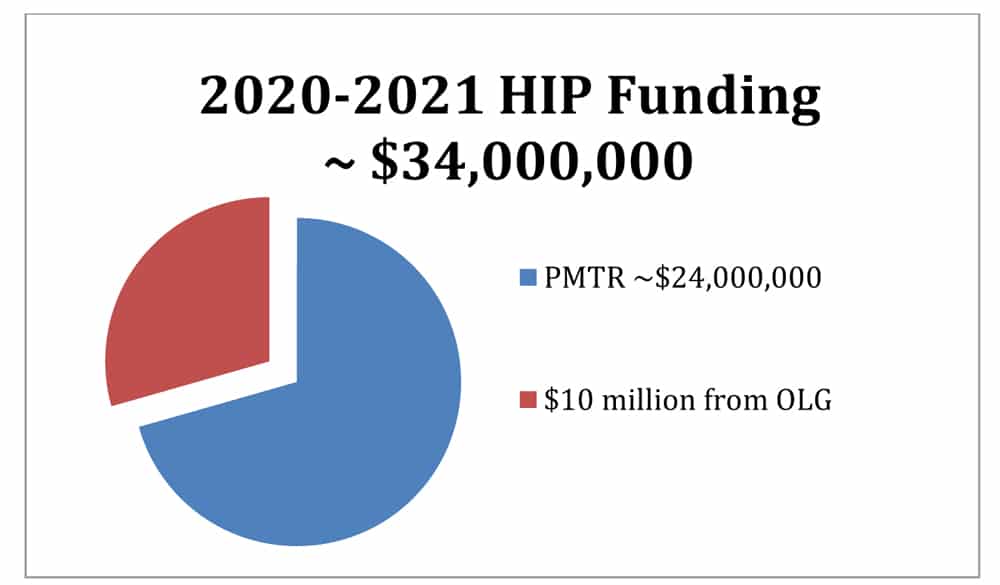

Considering how critical the Horse Improvement Program (HIP) is to funding vital breeding programs in Ontario, it’s remarkable how little is known about the initiative which began in the 1970s and is key in funding breeder awards and purses. Considering much of HIP funding comes from wagering it is particularly important breeders better understand HIP to prepare for the future.

Prior to the Covid-19 pandemic, the 2020-2021 HIP budget was to be comprised of approximately $24 million from the 6.9% Pari-Mutuel Tax Rebate and $10 million from OLG (sometimes referred to as Enhanced HIP).

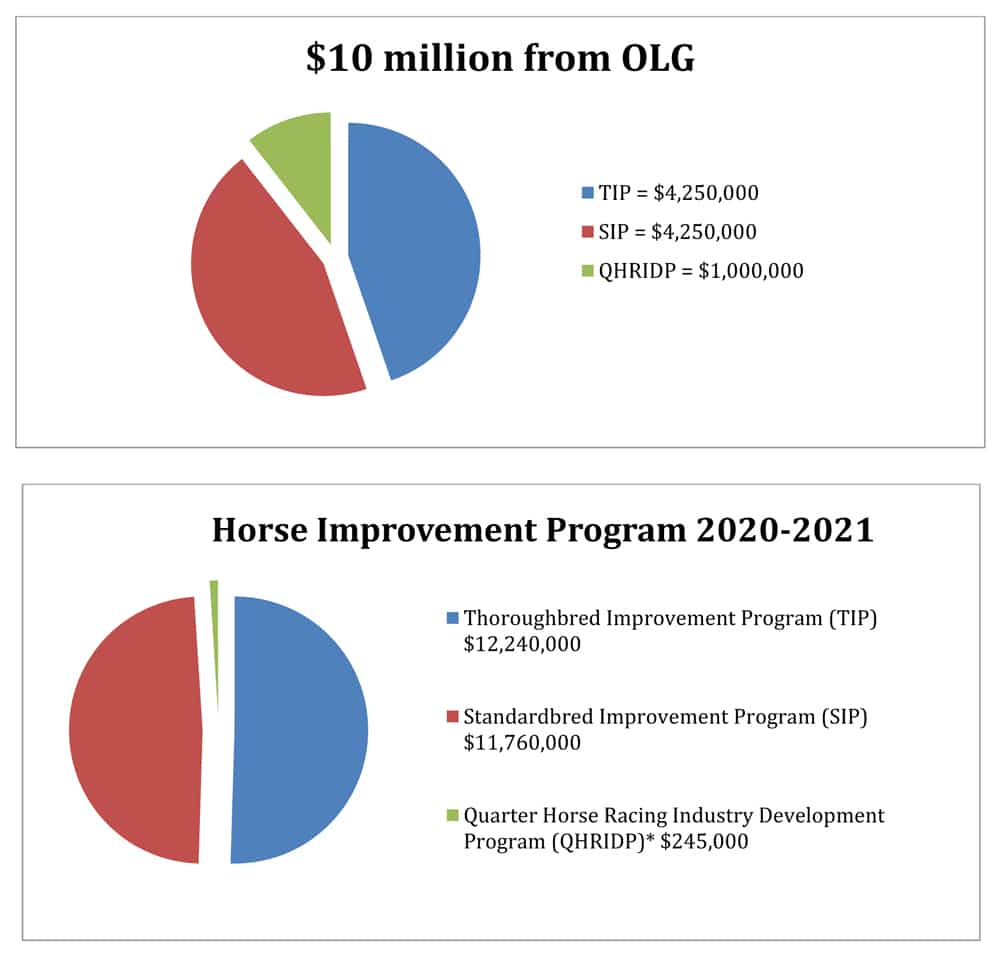

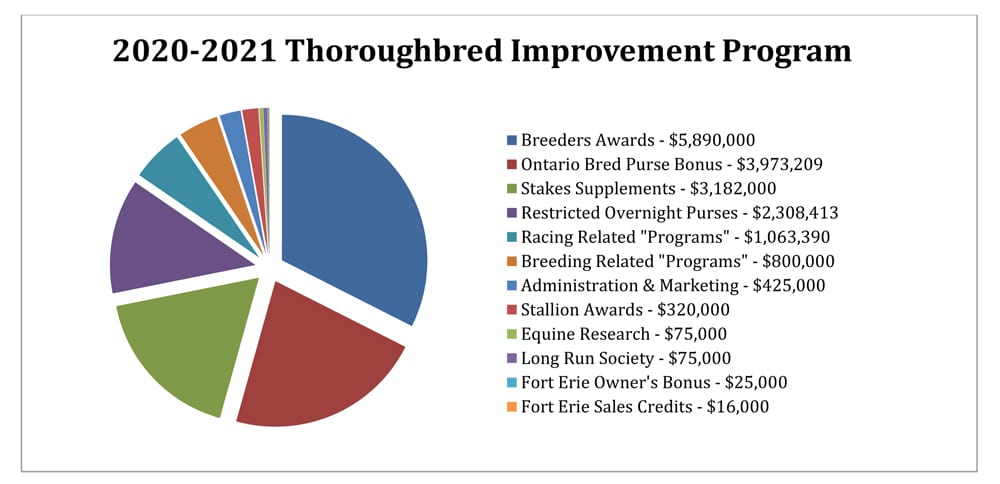

Currently, HIP is administered by Ontario Racing (OR). The program, which is funded mostly through a percentage levy on wagering, is comprised of three breed-specific components, which develop program elements specific to their breeding and racing sectors: 1. Thoroughbred Improvement Program (TIP) 2. Standardbred Improvement Program (SIP) and 3. Quarter Horse Racing Industry Development Program (QHRIDP).

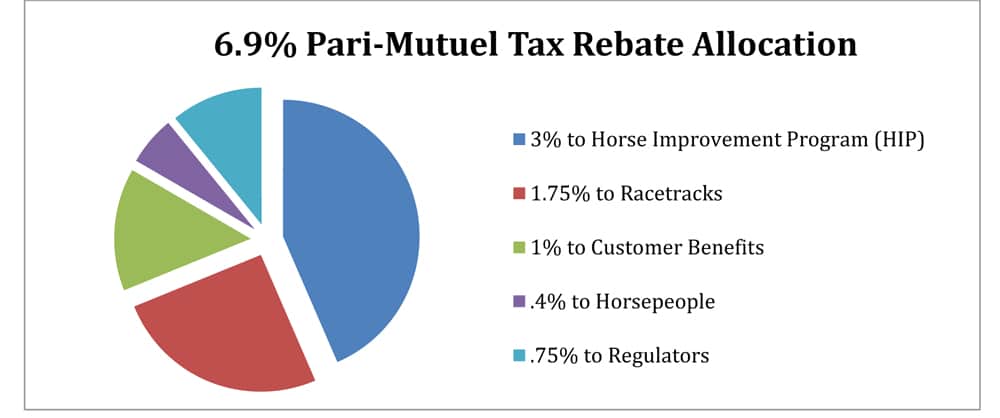

The Ontario racing industry earns a 6.9% Pari-Mutuel Tax Rebate (PMTR)

from all Ontario-based wagering.

How did we get here?

Woodbine’s former executive vice-president of racing Jamie Martin, who is now the director of operations for Grand River Raceway, explains that early in HIP’s history it was funded by a, “2 per cent tax on all wagers and an additional 2 per cent on triactor wagering” for an average funding of 2.4 per cent of wagering. This was on top of a provincial tax on wagering, at that time, of 5 per cent.

In 1995, Ontario’s Mike Harris Progressive Conservative government initiated a Pari-Mutuel Tax Reduction (PMTR) and launched the Slots at Racetracks Program (SARP). Both benefitted HIP. The PMTR not only retained HIP’s funding of 2 per cent tax on all wagers and an additional 2 per cent on triactor bets, but, also, each breed’s horspeople’s association received 1 per cent and a portion of that 1 per cent was directed toward HIP.

As for SARP, a little over 8 per cent of each breed’s share of slot revenue was allocated toward HIP.

Martin said that in 2006 or 2007, “a full review of HIP was done. Before that, 70 per cent of the thoroughbreds’ share of HIP and 59 per cent of the standardbreds’ share of HIP was returned to the track purse account to be paid in overnights. No conditions. Breeders were concerned as they weren’t seeing the benefits of SARP. The results of the review were that the overnight HIP money needed to be directed to Ontario-Bred or Ontario-Sired events. Standardbred funds all stayed in the (Ontario Sires Stakes) program. The thoroughbreds created the Ontario-Bred bonus, which ultimately got to 20 per cent.”

After SARP ended in 2013, that percentage of HIP funding also ended and the percentage taken from wagering to fund HIP was changed to 3 per cent.

For much of its history, HIP was split between the breeds based on the percentage of wagering on each breed. On average, that split has been 60/40 in favour of thoroughbreds over standardbreds. After SARP ended, the HIP split was made to be 50/50.

“In 2013, the government guaranteed the program at $30 million (total) per breed, nearly $15 million for each and a bit for quarter horses,” Martin said. “Since neither breed earned $15 million from HIP tax, it made the split moot. In 2014, with the creation of the Standardbred Alliance the $30 million remained, topped up by Woodbine. That was only supposed to be for one year, but Woodbine topped it up for a couple more, then started to reduce (its contribution to HIP) to zero.”

In 2019, the thoroughbred industry lobbied for a return to the PMTR split based on handle instead of the straight 50/50 split. That effort was unsuccessful, but the split was adjusted to 53% for thoroughbreds and 47% for standardbreds, moving to a 55/45 split in the 2021-2022 cycle.

Currently, on top of the proceeds of pari-mutuel wagering, purses for all breeds in Ontario are funded by “up to” $105 million in annual investment from the Long Term Funding Agreement (LTFA) that was put in place for 19 years beginning in 2019. Meanwhile, critical breeder programs are funded, mostly, by the amount of wagering. Shouldn’t it be the other way around and the government should directly fund critical breeder initiatives such as HIP and purses should be more dependent on wagering?

“Good question,” Martin said. “The Pari-Mutuel Tax Reduction (of 1995), although revised, remains in place and I expect it was simpler to leave that as it is. Remember, in thoroughbreds, it is a co-funded program, so Woodbine is using stakes and overnight funds to support restricted racing opportunities.” Martin is referring to the fact that TIP provides approximately 55 per cent of the purses for the restricted stakes schedule while Woodbine funds the balance.

As for what will happen to HIP funding for next year now because thoroughbred racing lost a month and half of racing with no wagering in the province, Martin said he could only make an educated guess based on last year’s wagering numbers.

“If wagering is $800 million (annually) that leaves $24 million for HIP, plus OLG funds,” Martin said. “Losing two months could be a loss of $4 million total (in HIP funding for 2021), split between the breeds.”

The TIP budget is subject to review at the end of July, and may be amended at that time.